Get Started With

servzone

Overview

There are businesses in India that begin their journey as Limited Liability Partnerships (LLPs), but are now willing to turn into a private limited company for greater growth and prosperity in the business. The provision mentioned in Section 366 of the Companies Act, 2013 and the Companies (Registered for Authorization) Rules, 2014, states that LLP can be converted into a private limited company.

Before you step into the business of a private limited company, there are several requirements that you may need to convert LLP into a private limited company, for example, LLP requires seven partners and approvals. . All partners are required. An advertisement is published in both local and national newspapers, a No Objection Certificate (NOC) is obtained from the ROC where the LLP is registered and then all incorporation processes begin.

LLP V/s Private Limited Company

LLP is mainly suitable for small businesses with an annual sales turnover of less than Rs 40 lakh and capital contribution of less than Rs 25 lakh. LLPs that meet these conditions do not have to undergo an audit every year, on the other hand, a private limited company is required to audit its financial statements every year. However, if the annual turnover of an LLP is a capital contribution of Rs 40 lakh or more than Rs 25 lakh, the requirement for compliance is almost the same for both the private limited company and the LLP, forcing the owners of the LLP to convert. A private one does. limited company.

Corporatization has become the need of the current market situation. We live in a world where the reverse goal of every market is to drift towards a global market, which removes barriers between countries. There are many start-ups and entrepreneurs who are eager to step into corporateization. Follow the steps below to start the process:

Advantages

- Protection of brand value

Conversion of LLP into private limited company facilitates business entities to continue the brand name without any further efforts on brand advertisements.

- Carry forward without loss and depreciation

After conversion, there will be no expense on bookkeeping, as losses and depreciation in LLP will be carried forward to unit conversion

- Employee Stock Ownership Plan for Employees

Conversion of LLP to private company allows companies to offer stock ownership and ESOP plans. Such schemes help companies to attract skilled employees, as it provides them incentive scheme to work in the company.

- Easy Fund Raising

If the company registration process is strict, it helps to make the company structure more reliable among others. This leads to easy funding from external sources.

- Separate Legal Existence

The conversion of the company allows individual ownership and management to focus on their potential tasks. The shareholders give responsibility for running and operating the company without losing control in the form of voting.

- Owner Limited Liability

The conversion only bans the owners' fixed capital that is subscribed and unpaid by them.

Reason for LLP registration

- To make small businesses aware of the concept of LLP.

- Easy to start and control

- Gives the benefit of limited liability and also provides flexibility to organize your firm internally.

- If annual sales exceed Rs 40 lakh, then audit is not required and capital contribution does not cross the limit of Rs 25 lakh.

- LLP is not obliged to pay Dividend Distribution Tax (DDT).

- It is not necessary for LLP to hold a board meeting or annual meeting.

- The registration process of LLP is simple as compared to private limited company.

Required Documents

- Address proof of the applicant

- Applicant Identification Proof

- Passport size photo of the applicant

Reason for Private Limited Company Registration

- LLP does not entertain the concept of shareholders. In an LLP, all the owners are treated as partners in the LLP and are considered unsuitable for investors such as venture capitalists and private equity investors who have no desire to engage in the management of the company. Private company is the best option for investors. If the business is growing, the owners will have to convert it into a private limited company.

- FDI is gaining popularity in the Indian market. A private limited company does not require any approval from government officials for FDI, whereas FDI in LLP requires a lot of government approval.

Documents required at the time of filing Form URC-1

- Details such as name, address and shares held by the members along with the member’s list.

- Fill the details like name, address, DIN, passport number along with expiry date of all directors of private limited company.

- Also, for registration of the company, file all the mandatory documents with the Registrar of Companies

- Limited Liability Partnership is a certified copy of the partnership agreement and registration with a list mentioning the names and addresses of the partners of the LLP duly verified by at least two designated partners of the LPP.

- The statement along with the statement of the firm's nominal share capital and number of shares is limited to the number of shares taken separately and the amount remitted for each share and the name of the firm with the term private.

- NOC to be provided from all creditors.

- A duly attested statement of the company by the auditor, which should not be less than six days from the date of application and a copy of newspaper advertisement is required.

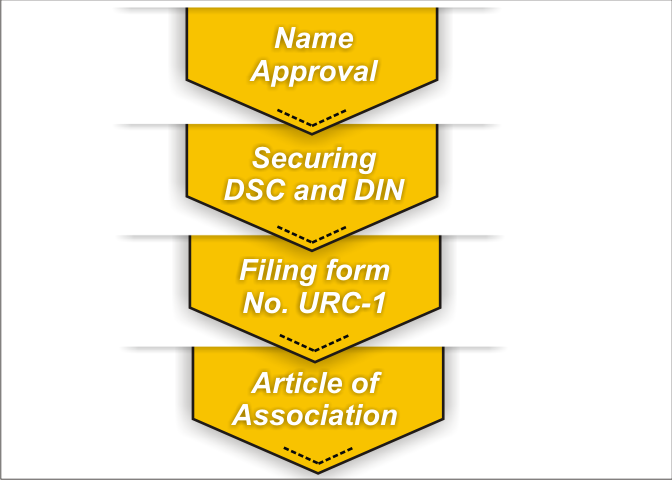

Conversion Process

Let’s dig in further and discuss each process in detail.

- Name Approval

Obtain ‘Name Approval’ from the ROC (Registrar of Companies) by giving an application in e-format.

- Securing DSC and DIN

It is required for all seven directors of the company to obtain a Digital Signature Certificate (DSC) and Director Identification Number (DIN). The DIN can be obtained by filing an application on the MCA portal. The Central Government approves the application of DIN through the Office of the Regional Director, Ministry of Corporate Affairs. Before submitting the form, be sure to self-attest with a passport size photo of the applicant along with address proof and identity proof.

- Filing of Form URC-1

Once you obtain the name approval from the Registrar of Companies, the applicant is required to prepare and file a URC-1 form.

- Memorandum of Association and Article of Association

Form a Memorandum of Association (MOA) and Association of Associations (AOA) and send it to the Registrar of Companies. Once you get the approval of the company name, the Registrar of Companies issues the URC-1

form.The growth of business is mainly due to conversion of LLP into a private limited company. The LLP framework is not fit for venture capitalists or private equity, as well as investors are more comfortable investing in a private limited company. Even for the purpose of FDI, private limited companies are considered to be a better option than LLP. Therefore, conversion of LLP to private limited company can be a wise decision and will be made keeping in mind all the laid down rules.

GST Registration

PVT. LTD. Company

Loan

Insurance